Categories > Other Services

5 Best Mortgage Brokers in Singapore That Know All the Fine Print (And Loopholes!)

Who knew that a mortgage broker could make my friend’s dream come true?

My friend and his wife have been house hunting for a while. However, they were either offered subpar rates or a narrow range of loan options; that’s when I gave them a list of the top mortgage brokers on the island.

After a couple of consultations, they were given a solid home loan, which allowed them to buy their dream home. Talk about a happily ever after!

If you’re also struggling to secure loans, here are Singapore’s best mortgage brokers to help you snag your forever home.

1. Redbrick Mortgage Advisory

Media credit: redbrick.sg

Services: Home Loan, Commercial Property Loan, Bridging Loan, Equity Loan

Location: 1 Coleman St, #08-11 The Adelphi

Contact: +65 9169 9662

Business hours: Mon – Fri: 9 AM – 6 PM

Website

Instagram

| Google reviews score | 5/5 |

| Facebook reviews score | 5/5 |

| Total reviews | 5/5 |

| Score consistency | 55 |

| Expertise | 5/5 |

|---|---|

| Loan Access | 5/5 |

| Cost Savings | 5/5 |

| Customer Satisfaction | 4/5 |

Founded in 2013, Redbrick is a mortgage advisory firm that helps you compare and secure the best home loan or refinancing deal. This means you don’t have to visit 16 different banks (because who has time for that?),

Their team of mortgage advisors will go over 100 loan packages from big names like DBS, OCBC, Citibank, HSBC, Maybank, and more. Then, they’ll guide you through confusing things like Buyer’s Stamp, Additional Buyer’s, and Seller’s Stamp Duties.

If you prefer to do the comparison yourself, their site offers various helpful tools like a TDSR, BSD, SSD, and mortgage calculators.

All in all, they’re pretty much hands-on throughout the home loan process. No wonder they’ve been featured on CNA and The Business Times.

Unfortunately, we heard from a few users that some of their advisors can be a bit pushy.

Successfully negotiated a better loan package

“Ivan from Redbrick provided exceptional housing loan advisory services. I was overwhelmed by the complexity of loan options, but Ivan quickly understood my needs and delivered a tailored shortlist within a day. His proactive approach and professional expertise saved me significant time. Importantly, he prioritized my interests, successfully negotiating an even better loan package on my behalf. I highly recommend Ivan and Redbrick to anyone seeking expert, client-focused housing loan advice.” — River, Google Review

Very responsive and proactive

“Mary Ann Bey from Redbrick was very responsive and proactive during the entire loan process. She was very meticulous in her explanation to make sure I understood the pros and cons of the various loan packages. I’m very glad to have met her during this process, as her professional advice helped me greatly to navigate the complexity of selecting the loan package.” — Koh Chee Wee, Google Review

2. Mortgage Master

Media credit: cpcksg

Services: HDB Loan, Private Property Loan, Refinancing Home Loan

Location: 1008 Toa Payoh N, #05-17

Contact: +65 6974 7673

Business hours: Mon – Thurs: 10 AM – 7 PM

Website

Instagram

| Google reviews score | 5/5 |

| Facebook reviews score | 5/5 |

| Total reviews | 5/5 |

| Score consistency | 5/5 |

| Expertise | 5/5 |

|---|---|

| Loan Access | 5/5 |

| Cost Savings | 5/5 |

| Customer Satisfaction | 4/5 |

Mortgage Master is a one-stop mortgage platform that’s free to use. It’s designed to help make your property journey as smooth and painless as possible.

First, they do a Loan Eligibility Assessment. Then, they help you prep your required documents via a comprehensive checklist and guide you through the In-Principle Approval (IPA) step-by-step.

We like that they have access to unpublished home loan rates—those juicy, behind-the-scenes deals you won’t find just Googling around.

And thanks to partnerships with top lenders and banks like DBS, CIMB, Citibank, and more, they’re able to offer some of the lowest rates to clients. That’s probably why they have referred over $800 million in loans and helped over 6500 happy clients.

A small heads up—we heard about their agents being a tad too aggressive.

Gave genuinely unbiased and helpful advice

“Seriously impressed with Adam from Mortgage Master! He gave me a call about refinancing, and I was blown away by his genuinely unbiased and helpful advice on my existing mortgage. He broke down the pros and cons of using cash versus CPF in the long run so clearly, even sending visual aids to illustrate his points. I only wish I had connected with him years ago to better plan my mortgage. What impressed me most was his honesty – after running the numbers, he actually recommended I refinance with my current bank. Highly recommend his services, so if you need mortgage advice, look no further :)” — Jill Chong, Google Review

Helped me secure the best possible rate

“I had a fantastic experience working with Francis Chua for my mortgage needs. His mortgage advisory service was seamless, speedy, and extremely helpful throughout the entire process. Francis was always responsive, provided clear explanations, and helped me secure the best possible rate for my situation. His professionalism and dedication made what could have been a stressful journey feel effortless. Highly recommend his services to anyone looking for expert mortgage advice!” — Thanushan Kanagarajah, Google Review

3. Dollarback Mortgage

Media credit: jingwensathome

Services: HDB Loan, Private Property Loan, Condo Loan, Refinancing Loan

Location: SYNERGY @ KB building

Contact: +65 9298 6367

Business hours:

- Mon – Fri: 10 AM – 8 PM

- Saturday: 10 AM – 5 PM

| Google reviews score | 5/5 |

| Facebook reviews score | 5/5 |

| Total reviews | 5/5 |

| Score consistency | 5/5 |

| Expertise | 5/5 |

|---|---|

| Loan Access | 5/5 |

| Cost Savings | 5/5 |

| Customer Satisfaction | 4.5/5 |

Dollarback Mortgage believes that every homeowner deserves to understand the pitfalls and loopholes hidden in the fine print of mortgage loans.

Their team compares 145 home loan packages from 18 banks, including big names like DBS, HCBC, Citibank, and UOB. Direct loan applications with them are offered, too.

And we like that they sweeten the deal with exclusive rewards. For instance, if you’re buying a new property or refinancing your current one, you can walk away with up to $3,300 in vouchers.

To help with the legal side of things, they work with partner law firms (some of which are on the panel of Singapore banks). This is especially useful for those needing conveyancing support.

One thing to note: we heard about them missing scheduled follow-up calls.

Secured the best mortgage rate for me

“I highly recommend Jovin from Dollarback Mortgage for his exceptional professionalism and expertise. He secured the best mortgage rate for me from the outset, and impressively negotiated an even lower rate with the same bank during confirmation! His end-to-end service for my refinance was seamless and thorough, giving me complete peace of mind.” — Eleen Tang, Google Review

Straightforward and were not pushy at all

“I reached out to various mortgage brokers for my private property purchase in June 2025, and eventually decided to proceed with Dollarback Mortgage. I liaised with Joel and Jovin, who were helpful and professional throughout the process. I like that they are straightforward and were not pushy at all (which is a dealbreaker imo). Will definitely go back to them once my lock-in period expires.” — Mr Lee, Google Review

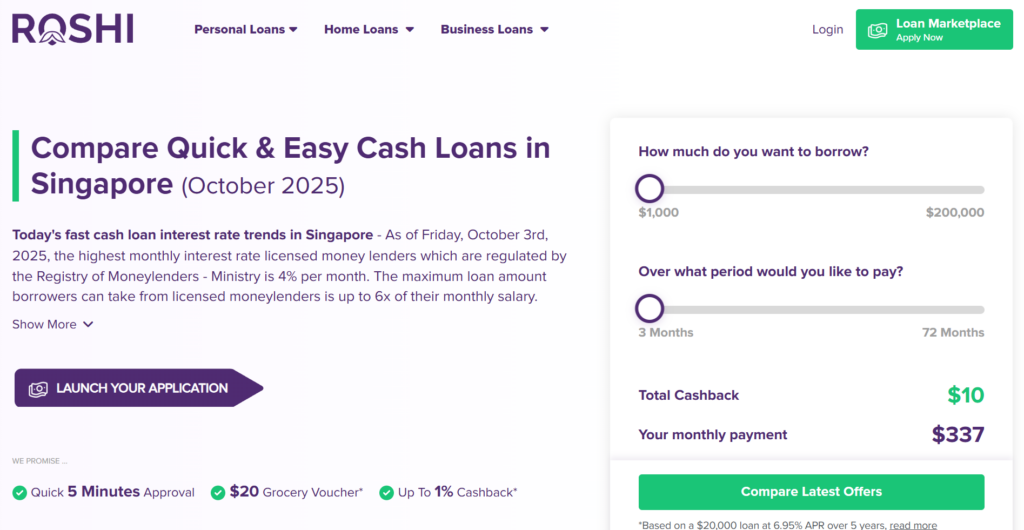

4. Roshi

Services: Personal Loans, Business Loans, Home Loans

Location: Singapore

Contact: Contact them via their website

Business hours: By appointment basis

Website

Instagram

| Google reviews score | 5/5 |

| Facebook reviews score | 5/5 |

| Total reviews | 5/5 |

| Score consistency | 55 |

| Expertise | 5/5 |

|---|---|

| Loan Access | 5/5 |

| Cost Savings | 5/5 |

| Customer Satisfaction | 4/5 |

We recently worked with Roshi for our mortgage, and the experience was smooth, transparent, and far less stressful than we expected. From our first conversation, the team made it clear that they valued clarity and personal attention. They took the time to explain every step of the process—breaking down terms, comparing options, and helping us understand how each choice would affect our long-term goals. That kind of patience and honesty made all the difference.

What stood out most was how proactive and responsive they were. Whenever we had a question or needed clarification, someone got back to us quickly with clear, thoughtful answers. We never felt like just another file in a queue; it felt like they were truly invested in helping us find the best possible solution. Their guidance helped us secure a rate and structure that fit our situation perfectly, and they managed the paperwork with precision and efficiency.

Throughout the process, Roshi balanced professionalism with genuine warmth. Even during the more complicated parts, they stayed calm, reassuring, and focused on finding solutions. By the time we finalized everything, we felt confident and well taken care of.

Roshi turned what could have been a daunting process into a positive, empowering experience. Their transparency, expertise, and personal touch set them apart, and we wouldn’t hesitate to recommend them to anyone looking for mortgage support that feels both smart and human.

5. FinanceGuru

Services: Home Loans, Refinancing

Location: 12 Arumugam Rd, Suite B #02-02B LTC Building

Contact: +65 9890 9090

Business hours: Mon – Fri: 9 AM – 9 PM

Website

Instagram

| Google reviews score | 4.9/5 |

| Facebook reviews score | 5/5 |

| Total reviews | 4.9/5 |

| Score consistency | 4.9/5 |

| Expertise | 5/5 |

|---|---|

| Loan Access | 4/5 |

| Cost Savings | 5/5 |

| Customer Satisfaction | 35 |

FinanceGuru was co-founded by Matthew Kurian, a lawyer and Managing Director of Regent Law LLC. The platform brings a mix of legal smarts and mortgage know-how to the table.

They’ve partnered with 16 major banks in Singapore, including DBS, OCBC, UOB, and POSB, to help you compare home loans.

What’s great is that they go beyond numbers. They’ll also highlight any blind spots you might not have thought about, such as long-term flexibility or hidden fees.

Plus, they handle tricky paperwork and provide customer support from start to finish. No answering endless forms alone at 1 AM.

One thing to watch out for—we heard about advice given to clients that didn’t quite hit the mark. You might want to ask questions and double-check key details.

Most professional and knowledgeable mortgage broker

“Jasper helped me with my home loan when I bought my place. He was the most professional and knowledgeable mortgage broker I have gotten in contact with during that period. Was able to answer my queries and clear my doubts. Thinking in my best interest and putting forward the most suitable plans for me to choose from. Fast, responsive & professional. He made this home purchase journey easier. Will definitely engage them again when it’s time for me to refinance my home loan!” — Lee Yee Han, Google Review

Always has our best interests at heart

“Jasper is always responsive, provides answers to queries promptly, and always has our best interests at heart, even if it means he does not get the referral fee, because the best option was to refinance with our existing bank. I find this extremely professional, and he continued assisting us in understanding the terms involved. I have recommended him to friends, and all of them have benefited greatly from his service. Highly recommended.”

— Mandy Koo, Google Review